PROSHARES TRUST (NASDAQ:SQQQ)

Old Forum Content for SQQQ

Make a Forum Post Become a member to view recent forum posts. Already a member? Sign in here.

- scottthomasee: Sold a bunch, probably not enough, and hedged with $SDOW, $SQQQ, $SPXU

- Dig44north: @ReneeH $TLT $SQQQ opened the Oct 18/21 BuCs. Very liquid

- ReneeH: @Dig44north $TLT $SQQQ thanks for sharing. I like the simple approach straight up longer dated calls/puts....this $TLT might be a "thing" we'll know soon.

- Carpe_Diem: $VIXY $SQQQ $SH - Might be a good day to keep an eye on the VIX. Options Exp. day tomorrow and we haven't gotten the August - Sept. road bump.

- djgustoso: @TraderGeekSam $TQQQ $SQQQ #chocolatecoveredhandgrenades does this also apply on $MSTX and options on that?

- TraderGeekSam: @djgustoso $TQQQ $SQQQ $MSTX #chocolatecoveredhandgrenades Definitely!

- TraderGeekSam: If you bought the 3X levered NASDAQ 100 ETF $TQQQ on 12/31/24, you'd be up about 16.4% year-to-date, not even 1.5X. If instead you had shorted the inverse 3X $SQQQ, you'd be up about 44%. Still want to buy or sell options on 3X leveraged instruments? #chocolatecoveredhandgrenades

- ReneeH: @TraderGeekSam $TQQQ $SQQQ #chocolatecoveredhandgrenades fwiw with the 3x ETFs $SOXL, I like em for covered calls, short term 2 weeks avg. They degrade over time inefficiently imo.

- Wolf: @Henry $QXO There is always the inverse ETF's. $SQQQ....

- billyzeke: @champ $COMPX $NDX $DJI $SPY #only $SQQQ to the rescue

- champ: @billyzeke $COMPX $NDX $DJI $SPY $SQQQ #only....Yes but be careful because the Markets might turn this Powell move back-up, at some point today, is the guess.

- billyzeke: @champ $COMPX $NDX $DJI $SPY $SQQQ #only....Yes Just got out, gonna give it a minute and watch

- billyzeke: @billyzeke $COMPX $NDX $DJI $SPY $SQQQ #only....Yes Rode up to the 20 and 8 day lines, might turn now

- Doug: @billyzeke $SQQQ EU said little progress with trade talks.

- billyzeke: @Doug $SQQQ That'll do it, thanks for the info.

- billyzeke: Not sure what the news was but I had a feeling and nailed that drop with $SQQQ for a quick 2% gain. Edit: 2% gain not 4% -typo

- woodman: @Doug $SQQQ No serious minded person can possibly believe that the Administration can do 90 deals in 90 days. It's a fantasy. It took over 2 years to do the comprehensive US-Canada-Mexico trade deal. It took over 8 months to do the much smaller automotive and steel provisions of the US-South Korean Free Trade Agreement. These guys are just making $hit up. The only way they can achieve this goal is to do more what they have been doing: negotiating against themselves. That's fine, because this entire tariff plan - based on made up calculations that have nothing to do with anything - is so utterly ill-conceived.

- champ: @billyzeke $SQQQ ....Negotiating are going on and they might takes months on the easy ones.......however what is going to happen when there are agreements, starting to take place ......and that's an easy guess......... ...and Tariffs only started on April 2nd...... ....and for Now, traders are making $$$ off of the easy zig-zags, on their trading $$$ now, off of that low zig-zag turn.....and this is only Day-5 off of that low turn, that started on 4/9, on the $SPY and many other ETF's and stocks. However even for stock pickers, that have some entry and exit timings, guessing is #never easy.....but for Banks and others who trade with their customers $$$, then it is real easy....but Not for us.

- joelsg1: @woodman $SQQQ $hit In 2003, Warren Buffett warned about increasing trade deficits with certain nations causing drop in US dollar and proposed a solution. Of course, the dollar thrived and the $SPY quintupled since then, but it's an interesting read, and here it is: https://www.berkshirehathaway.com/letters/growing.pdf

-

Geewhiz: @joelsg1 $SQQQ $hit $SPY Worth reading. Thank you. Final paragraph if you don't wish to read the entire article. "will close by reminding you again that I cried wolf once

before. In general, the batting average of doomsayers in

the U.S. is t ... - Wolf: Guess I am the only one that woke up before 5AM to look at the carnage. Guess it was worth it. Made a little on $SQQQ PM.

- Henry: @Wolf $SQQQ SPY futures were down 260 last night.

- Wolf: @Henry $SQQQ I just read an article from Daily Beast about Trump playing golf last weekend. At one point on Friday, as stocks slumped even farther, Trump posted to Truth Social that “THIS IS A GREAT TIME TO GET RICH, RICHER THAN EVER BEFORE.” Is this a clue?....

- bigbartabs: @DavidK $SQQQ $SPX $KO ... this the 3rd day I have opened out... owning 1 share each of $UDOW $SPXL $TQQQ $TNA. When on 4/2, the indexes couldn't get back above their 8dema 3 green candles... that was it for me until it does. Same thing on 3/21. Just not enough reason to be in the market. Alarms set with patience.

- billyzeke: $SQQQ easy money, just took profits.

- billyzeke: $SQQQ, Making money by going short makes me feel dirty, but ya gotta do what ya gotta do. It's over for the week, let's go clear our heads and enjoy the weekend.

- champ: @billyzeke $SQQQ $SDS $UVIX, over the last 2 Day these were easy trades easy trades.. however on Monday or Tuesday, things might change.

- Cjauger: @billyzeke $SQQQ I am short, however, I have a company that does a bull put strategy on $SPX, and they generate about a 6% yearly return. That position is under water, so my big short position is helping, but I am still red

- Cjauger: @champ $SQQQ $SDS $UVIX I hope that you are right.

- DavidK: @Cjauger $SQQQ $SPX after all said and done my trading account was up 6.5% and that’s after taking some decent losses when the shit hit the fan . I sold 90 % of longs and stayed sniper shoot shorts . Could have had a huge week these last 2 days but lightened up on puts overnight and then sold some other trades too quickly . Example . Made 27% on $KO puts and if had held them a few hours longer it would have been a 54% plus gain .

- Cjauger: @DavidK $SQQQ $SPX $KO Well done

- billyzeke: @Cjauger $SQQQ $SPX As @Sam said in his note this last night, "this too shall pass" and we will be back to making money on the upside. I'm not sure how long that will take but hopefully @Champ is right and we'll get a nice relief rally next week.

- billyzeke: @DavidK $SQQQ $SPX $KO Nice work, sounds like I need to learn how to trade options.

- champ: $UVIX $SQQQ, only Watching these 2 short ETF's...... and I'm Not holding any ETF positions for Now..... ....and I have Re-position, took Profits and for Now I'm only holding Energy-positions.

- bigbartabs: @champ $UVIX $SQQQ ... $SPX dropping below the 200dma again this morning was a surprise

- billyzeke: @champ $UDOW $QLD Ive been back and forth between $TQQQ and $SQQQ all day. lol

- champ: @billyzeke $UDOW $QLD $TQQQ $SQQQ ....I stayed on my plan, which I posted was, to take profits on the high turn and I did get back-in .....on that low turn that we just had and as of Now ...I don't know if I'm going to swing ...Yet, however everything is more or less looking strong for maybe a 1/2 size Spec swing.....????

- billyzeke: @champ $UDOW $QLD $TQQQ $SQQQ I'm torn because sometimes the day after the FOMC things reverse.

- champ: @billyzeke $UDOW $QLD $TQQQ $SQQQ...........I did get back out of my ETF's, at entries.

- bigbartabs: @champ $UDOW $QLD $TQQQ $SQQQ ... I'm out too, closing up shop

- playful2121: @billyzeke $UDOW $QLD $TQQQ $SQQQ that is what I was thinking too.

- billyzeke: @woodman $NVDA That's the only stock I've been holding a small amount of, bought a little back around 105 and have made a couple of small adds on the way up. Other than that I've only been day trading $SMCI $PLTR $TQQQ and $SQQQ. I still think the path of least resistance in the overall market is down for now, but ya just never know what MR Market is going to do.

- champ: $SQQQ and $SDS are both HOD.

- Wolf: @champ $SQQQ $SDS $QQQ The biggest one day drop in the past year was 3.8% on 12/18.

- champ: @Wolf $SQQQ $SDS $QQQ......The lower they go, the better it is, for when the next U-turn happens. Good Luck!

- champ: $NOC $HSY and $CPB......however the other side of the fence is Not working, $TQQQ..... ......but Stock-pickers are still working, $SQQQ.

- champ: @drmike54 #Turn_around_Tuesday ....either way, for now, every Trade, is only a guess trade, off of what we Think is going to happen.....so for Now, everything is mostly only Day by Day, short term and most all swings are under water, from the start of the year....... All Guess-trades, are Hope trades.....becuse all trades start off as a Day-trade on Day-1....... ....and the timing on an $SQQQ trade, also varies, from Day to Day...and this is Day-3, for $SQQQ....and that means, that it might not be swingable.......however most will know how to answer that, to play that trade, going into the close today. Good Luck! ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

- billyzeke: @woodman My best trade of the morning was on $SQQQ....yuck market.

- woodman: @billyzeke $SQQQ - I guess we should look at the bottom 15, rather than the top, for purposes of shorting.

- woodman: @billyzeke $SQQQ - And here are the bottom 15 over the last one week period, in order of worst to "best": Symbols from TC2000 iX1020 (building materials) XHB ITB XRT BITW MAGS DBA RTH IWM XLY XAR IYT MG630 (materials and construction) IBIT XME

- joelsg1: @joelsg1 $IBM $NVDA Got the 'can't help its', put on intraday long trade on $SQQQ.

- joelsg1: @joelsg1 $IBM $NVDA $SQQQ Out for small loss, too cute with $NVDA flying.

- joelsg1: @joelsg1 $IBM $NVDA $SQQQ Clockwork Orange daytrade, the old In/out/in/out.

- Bert953: @joelsg1 $IBM $NVDA $SQQQ WOW, gotta go in the wayback machine for that one!

- Wolf: $SQQQ Don't normally like trading PM, but was too obvious. Made a quick profit on $SQQQ.

- champ: Looks like $TQQQ is starting to take a hit, could now be starting to take some of those 2024 Profits off.......and direction in the tech sector could be unknown, for now. $SQQQ...it might be time..???

- bigbartabs: @champ $SPXS $SQQQ ... look at the last 4 days short volume

-

champ: ...

.....and for me, my only tech position that I'm currently holding, swinging is, only a small 100 shares trading position, in $SOUN...only because the tech sector, could be volatile, could be in play tomorrow and I'm waiting for trades to Pop-up, in ... - Wolf: $SQQQ Was down today until $SQQQ rescued me.

- champ: $AMZN $NVDA $ARM $META and others ...looks like the tech sector is getting hit harder than normal on #Options-Friday. ....$SQQQ.

- champ: $SDS $SQQQ $UVIX $UVXY $VXX.....I'm watching these ETF's and I'm holding $SDS and $UVIX positions for now....however Market-direction on the close is still #Unknown for Now, on all of these ETF's...... ....but the Markets could take a rest...... and Investors could take profits before the elections....... ....a lot of difference ways the Markets could play out before the Elections, at these high Market levels. I'm going into the Elections with Risk-Off and so far I'm only Day-trading these 2-short positions, I'm trailing both.......... and as of Now.....I'm Only swinging 1 long position. ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ The Markets will be telling me what to do, so I'm just going to follow the Markets and protect my YTD profits.

- champ: $UVIX $UVXY $VXX....$SQQQ $SDS $TZA $LABU........could be getting some new Set-ups, however the close will be in play, for sure today, for Market direction. ....For me, I'm now only holding 2 positions and 1 is $UVIX. And as of Now, Market direction is up in the air ....and is spinning around and where it stops is unknown. ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

- bigreek42: shorted $qqq against HOD . Just a hunch, actually $SQQQ better option

- joelsg1: $NVDA Took some more partial profits off a large pos. Strange market with large-cap strength supporting indecies (for now) because of perceived relative safety of the big boys vs negative seasonality of markets writ large. But if/when that perceived strength breaks, look out below. Also watching $SQQQ but Np yet.

- champ: @woodman $UVIX $TZA $OLLI $KMI #No-way #Computerized-trading....Today might want to watch $NVDA and $SVXY...for Market direction...for Entry on any short ETF's....like on $UVIX $UVXY or $SQQQ....and for Now I have NP's....however getting a small turn..RHRN.

- champ: ......Obviously these are the huge winners today $UVXY $VXX $UVIX.... plus $SQQQ $SDS $TZR are also zigzagging higher.... ....and it could be, that the Markets might continue this #turn-lower... for a few more days, maybe even for a few weeks, I wish I knew...and if it does,.....we could pick-up a years worth of profits, in just a few days, if this Market correction continues. ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ And as we all know, a Market correction can turn into a real nice gift and if the Markets wants to give me nice easy profits, I'm going to take them.

- champ: $VXX $UVXY $SDS $SQQQ .....I don't think anyone is really dumb enough to swing any of these short Day-trading positions, into $NVDA earnings report.

- champ: $UVXY $SDS $SQQQ....it looks like the Markets could continue this slide, however we will find out what the Markets-think in the morning....... and for me, #risk-management continues to be in play and I'm only holding a few downsize positions, for now. ....I'm not swinging any of these ETF's, however I might be trading $UVXY again in the morning...... ....Plus I might completely move-out of the Market in the morning...... and go back to only Day-trading, with a few swings, if the Day-trade was working nicely on the close, then I might swing 1/2 of that position or positionS into the open, #to-see if they continue. ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ ...The Markets might be do for a Rest and it might be time for swing-Risk, to be #turned-Off.....for a few weeks or so. ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

- champ: @chrisbman360 $UVIX $SDS $SQQQ ....I'm visual for now on my stop and it looks like I will be taking this overnight trade off, maybe around the open.

- champ: @chrisbman360 $UVIX $SDS $SQQQ ...My swing plan was to swing into the PM, for a look see...so I took this swing down for a small loss.....

- champ: $UVIX $SDS $SQQQ....I think I'm going to swing a $UVIX position.

- chrisbman360: @champ $UVIX $SDS $SQQQ Champ when you swing UVIX are you doing a tight stop or trailing stop as this ETF is a wild one? I've been swing it too and made a nice profit many times but also got stopped out too soon and miss out on the bigger gains.

- bigreek42: maybe $sqqq due for snapback

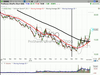

- Wolf: $SQQQ Took a small position Will close it if the QQQ starts setting higher highs and lows.

- champ: @Wolf #Late-again #recession.........These swings were the play....$UVXY $SDS $SQQQ $NUGT $GDX $GLD..... and Exactly... a mild or hard recession, for sure...... .....and they were Late-to-raise and Now they are going to be Late-to-cut....and thats is also exactly what has happened in the Past.... ....they let inflation climb too-Fast and Now they are going to Wait-too-long before they cut.....and mean-while the Economy will suffer again....and so will everybody else, who is on a budget and thats not good at all....... .....however some of #Politicians are really happy..... .....but it won't even phase most of us. .....So it is Now...100% certain that they are now going to cut in September. FWIW ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

- Wolf: @champ $UVXY $SDS $SQQQ $NUGT $GDX $GLD #Late-again #recession #Politicians With the #Fed, nothing is 100% certain. It is an election year, but Powell said they are not politically influenced.

- champ: @Wolf $UVXY $SDS $SQQQ $NUGT $GDX $GLD #Late-again #recession #Politicians #Fed...Yeah right or maybe they are just stupid...because they waited too long too-raise....I think that they need someone on their board, who is a Businessperson, who knows how to run a business, like James Dimon. ~~~~~~~~~~~~~~~~~~~~~~~~

- champ: @Wolf $UVXY $SDS $SQQQ $NUGT $GDX $GLD #Late-again #recession #Politicians #Fed.......#OT......I guess, if they are helping one side, politically.... it has to be the Republicans... because they are making it harder for the Democrats to win....because when they cut rates, inflation is not going to stop overnight..... and many won't be able to find a job...... .....and Pre-voting is already going to be starting in some states. ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

-

champ: ...

...and I also day trade and post on $SQQQ $UVXY and $SDS...because I have been doing this a long time and I have also been in the forum for a long-time.

- bigreek42: bought some $sqqq

- bigreek42: BOUGHT some $sqqq as hedge with 3% stop

- chrisbman360: Time to bail on my few remaining positions. Risk off though I'll have some fun with my hedges $SQQQ and $UVIX I picked up earlier in the week. Good luck everyone. I hope the bombs don't start flying. No body wins in that scenario.

- curtis: $SPXS $SQQQ - added both, seems like we are going on a voyage to the bottom of the sea, these are going the opposite direction.

- Craig97003: @curtis $SPXS $SQQQ I bought a tiny, tiny bit of $SQQQ.

- curtis: @Craig97003 $SPXS $SQQQ ( I think they said the silent part out loud, there will be rate hikes)

- champ: I'm holding $UVIX now at $12.00....and these are a few other Bear-ETF's.......$UVXY $SQQQ $SDS $TZA $FAZ $LABD.

- PTinME: @champ $UVIX $UVXY $SQQQ $SDS $TZA $FAZ $LABD $VIX up 10 percent while UVXY only up 8 percent. Without even looking this should mean $VIX futures are in contango so big boys are betting that the market will be higher down the road.

- champ: @PTinME $UVIX $UVXY $SQQQ $SDS $TZA $FAZ $LABD $VIX....ETF's are high risk and I never swing into the open, however I do swing into the AH's market but not into the open and if I do it would be small size........ ...For me ETF's are for Day-trades... .....and $UVIX is up over 11% RHRN...

- champ: @PTinME $UVIX $UVXY $SQQQ $SDS $TZA $FAZ $LABD $VIX...I agree about down the road, however I'm guessing that I will be getting #back-into some short positions in the morning, holding real small size now but I would like to step-back-up to large size...and it is always 1-Day at a time, on Day-trading these short ETF's,...Hope-trades... ...I think, that I might be able to, in the morning, obviously I will know more in the PM.

- champ: $UVXY $SQQQ $SDS $TZA $FAS $KRY $LABD....everything is dropping and this drop could continue.

- vcondry: @champ $UVXY $SQQQ $SDS $TZA $FAS $KRY $LABD good day to go Fish.

- champ: @vcondry $UVXY $SQQQ $SDS $TZA $FAS $KRY $LABD...Everything seems to be settling down now....the #Green light might slowly turn-on, moving-up off of the LOD's or could hold around these current price levels, we will see how the last hour or so goes. .....had some panic selling, the #CopyCat-sellers were active...but for now the herd looks to be settling down.......

- natural: @DavidK $IWM $QQQ That makes two of us. Long a little $SDS as well and $SQQQ.

- champ: $SPY...it looks like this drop is going to continue into the close, looks like reversal-day off of yesterdays ATHigh..... ....however the $VXX $UVXY is flat......... ....$TZA $TZA $SDS $SQQQ....now I'm watching these ETF's, for direction. However nothing really going on Yet.

- champ: $SQQQ....could maybe see a nice bounce, if the tech sector collapses going into the close.

- champ: $SQQQ...be ready to Add or Exit if needed....need to have windows open.....

- champ: $UVXY...$SQQQ....sure looks like these grave-diggers could be setting-up.....we are going to find out.....soooon, however could go back the other way.

- champ: ......$SQQQ, will this Tech #rotation continue,....and for me, I sure don't know, however I'm #not holding any tech positions........ ....however I'm expecting new trading opportunities to pop-up....... ....new Day-Trades....and a lot of shorts are working for Now....with Trailers.

- champ: #News always matters and tomorrow there will be know major Economic reports...... ....however on Thursday, the Markets will get the Retail numbers for the month of January.......... ....and then on Friday, the PPI numbers will be reported for the month of January and they might come in so/so...and maybe the Markets will not get hit like it did today, however the damage was already done by the CPI report this morning. ~~~Now we can start looking to see if we can find some #Bounce-Candidates. ...and $OLLI was only down $0.30 today, on above average volume..... ...and $BITI had a nice bounce off of LOD....... ...and $UVXY was up about 11% today....... ...and $SQQQ was up 4.8%...... ...and $TQQQ was up $1.44 off of LOD..... and in the morning we will all find out which way the wind in the Markets are blowing...and maybe know wind would even work.

- billyzeke: $SQQQ Newbie question, but for those of you that use things like $SQQQ as downside protection, how do you calculate how much to buy? Saw some mention SQQQ yesterday and it got me thinking about how to use it should the need arise.

| Stock Price | $66.26 |

| Change | 3.73% |

| Volume | 81,403,800 |

The investment seeks daily investment results, before fees and expenses, that correspond to three times the inverse (-3x) of the daily performance of the NASDAQ-100 Index®. The fund invests in derivatives that ProShare Advisors believes, in combination, should have similar daily return characteristics as three times the inverse (-3x) of the daily return of the index. The index, a modified market capitalization-weighted index, includes 100 of the largest non-financial domestic and international issues listed on The NASDAQ Stock Market. The fund is non-diversified.

Request Video of SQQQAlready a member? Sign in here.

Past Month

Leading Peers

Past Month

Lagging Peers

Dan Fitzpatrick

Stock Market Mentor gives you EVERYTHING you need to succeed in the market; all in one place. How easy is that? Dan Fitzpatrick and his elite community of traders share trading ideas, strategies and much more. Dan Fitzpatrick--a world class Technical Analyst, trading coach and regular CNBC contributor--gives you access to all of this with a 30 day trial membership for just $7.77. Get started TODAY and start trading better TOMORROW with the following premium content:

- Nightly video Strategy Sessions with a game plan for tomorrow

- Got a stock you want Dan to look at? Just ask.

- Patent pending video alerts instantly delivered to you when one of Dan’s trading signals is triggered. This is not your typical price alert. This is a short video explaining the action you need to take to make money. No more “Woulda, coulda, shoulda”

- Access to over 90,400 stock analysis videos

- Access an ever expanding library (90,400) of educational videos that will save you time and make you money

Join a team of friends and traders that have one thing in common; a burning desire to succeed.

Become a Member Today!

Gain immediate access to all our exclusive articles, features, how-to's, discussion group and much more...

Satisfaction Guaranteed!

Your Stock Market Mentor membership comes with a 30 day, no questions asked, 100% money back guarantee!